757-717-1003

Are you ready to grow with us?

We were hoping we'd get a YES from you!

Do You Want to

KEEP MORE MONEY?

YOU CAN SELL | more real estate.

CanZell is a collaborative group of agents from all over the country that have come together to create a collective group. We focus on building strong & profitable businesses, streamlining the process, connecting and sharing strategies with one another. Your success is our collective success.

You don’t have to build your business alone. We provide you with better technology, multiple revenue streams, and local leadership to help you exceed your real estate goals while keeping money in your pocket!

We’ve put together 20 trending lead generators for you to get started generating more leads right away!

CANZELL CERTIFIED AGENT

Learn how to get leads with no cost for the LEAD just a 35% referral fee at closing

CANZELL VIP

We will Explain the difference between CanZell Movement and eXp.

REVSHARE WEALTH

Before CANZELL, there was no such thing as a retirement plan. Now you can relax and reap the rewards of your hard work, while your business continues to grow.

LONG TERM WEALTH

Before CANZELL, there was no such thing as a retirement plan. Now you can relax and reap the rewards of your hard work, while your business continues to grow.

COMMISSION AND PLAN GUIDES

NEW EXP CO-SPONSORSHIP PROGRAM

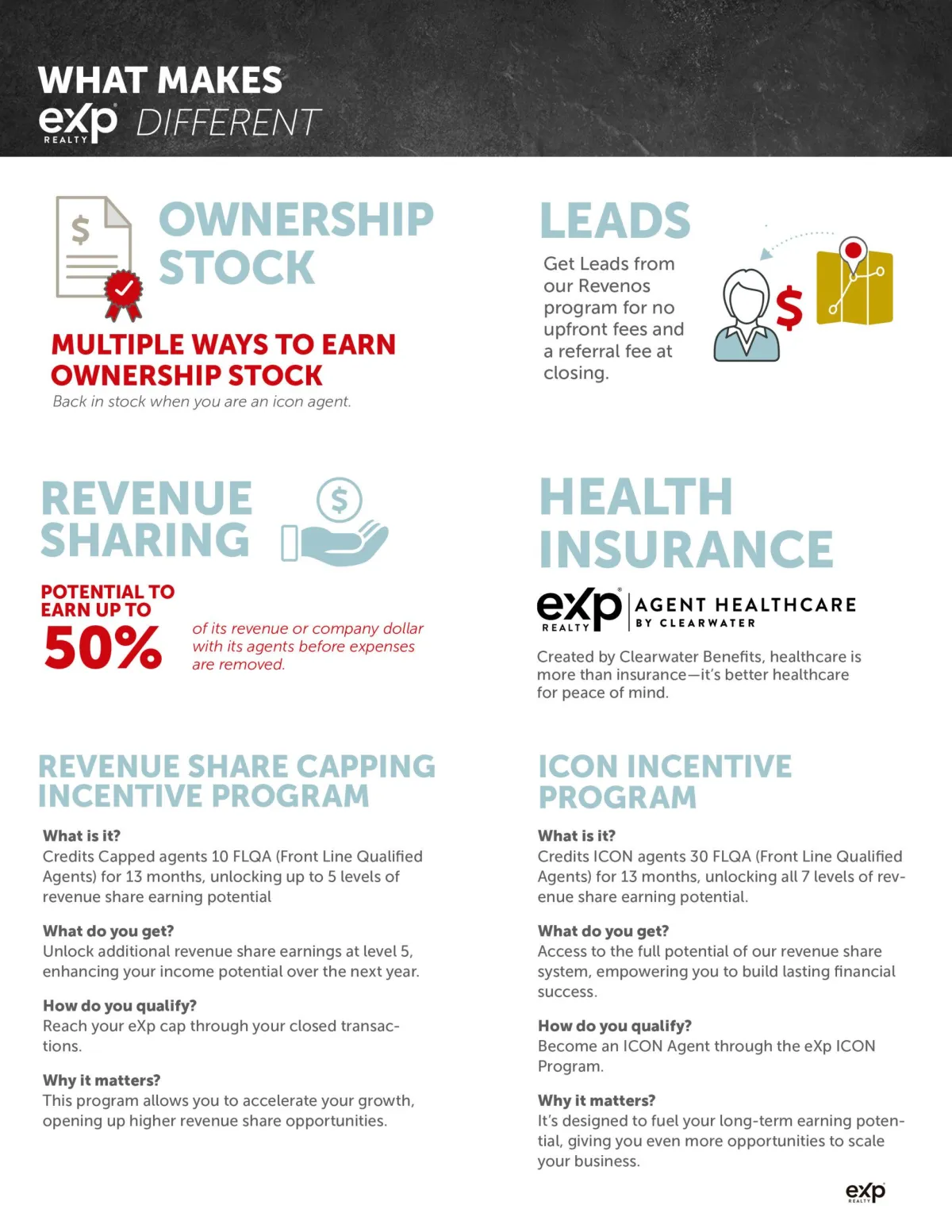

WHY EXP?

Discover what makes eXp Realty the ultimate choice for agents with innovative technology, powerful revenue opportunities, and unparalleled support.

Here is what sets us apart:

EXCLUSIVE AGENT BENEFITS

Canzell Community is a full-service brokerage with all of the agent tools you need to bring home the most commission.

Revenue Share

7 levels of potential income with 50% Company Dollar. Earn $16,000 per agent!

Try our Revenue Share Calculator.

Learn More

Ownership Stocks

You can earn ownership stocks as a reward.

Learn More

Leadership & Coaching

Coaching is available to all of our agents at NO COST through live training each week.

Learn More

Brand Yourself

Easily create self-branded marketing material in minutes with your picture, name, phone number and more, and when it comes to signs on your listings, you have control over how they will look.

Learn More

Technology Tools

Custom built websites, scheduling software, on-demand training, accounting, custom marketing & more. Save thousands of dollars.

Learn More

Giving Back

We donate 10% of Canzell’s profits to 10 charities per transaction. This is no cost to the agent!

Learn More

True 100% Commission Split

Our agents have the opportunity to earn 100% commission with a 16K cap nationwide no matter what part of the country you’re located in!

Learn More

Health Insurance

Most real estate companies DON’T offer insurance for 1099 employees! We aren’t like other companies, we offer better healthcare and concierge service.

Learn More

WHAT OUR AGENTS ARE SAYING

100% Commission

“I have sold over 30 houses this year, and now I’m only giving the company $16,000 for the whole year. And now I get 100% commission.”

John, VA

Broker

See what else Canzell is up to...

Copyright2025. USA. All Rights Reserved.